Unleashing the Future of Fintech with AI/ML and TuringBots

10% Worldwide Code is Generated by TuringBots ~ As per 2023 Forrester Prediction*

AI and Machine Learning in Fintech Testing Automation

In the ever-evolving landscape of financial technology, or fintech, staying ahead of the curve is crucial for companies seeking to provide seamless and secure experiences for their users. One of the key drivers of this evolution is the integration of artificial intelligence (AI) and machine learning (ML) into testing automation processes. This paradigm shift not only enhances test coverage, accuracy, and efficiency but also propels fintech applications into a new era of reliability and innovation.

The Rise of TuringBots: Redefining Automation in Fintech

TuringBots, inspired by the genius of Alan Turing, are taking center stage in the realm of automation. These intelligent bots, equipped with advanced machine-learning algorithms, are designed to mimic human-like cognitive functions. When integrated into Fintech platforms, TuringBots excel in tasks that require reasoning, problem-solving, and decision-making. Their ability to adapt and learn from data makes them indispensable in streamlining complex financial processes.

In the context of AI and ML in Test Automation, TuringBots prove to be a game-changer. Traditionally, testing financial software required extensive manual efforts, consuming time and resources. However, with TuringBots, the testing process becomes agile and efficient. These bots can simulate user interactions, identify vulnerabilities, and ensure the robustness of Fintech applications. As a result, Fintech companies can accelerate their software development life cycle, bringing innovations to market faster and with increased confidence.

Fintech Trends: A Glimpse into the Future

The Fintech landscape is undergoing a seismic shift, driven by technological advancements. Among the prominent trends shaping the industry, the integration of AI and ML in Test Automation stands out. Fintech companies are leveraging these technologies to enhance the reliability and security of their platforms. The ability of TuringBots to conduct comprehensive testing ensures that financial applications meet stringent regulatory standards and deliver a seamless user experience.

Another noteworthy trend is the increasing adoption of AI in Fintech for risk management. Machine learning algorithms analyze vast datasets to identify patterns and anomalies, enabling real-time risk assessment. This proactive approach to risk mitigation enhances the stability of financial systems and safeguards against potential threats.

Furthermore, AI and ML are fueling innovations in customer service within the Fintech sector. Chatbots, a specific application of AI, are becoming ubiquitous in providing instant and personalized assistance to users. These conversational interfaces enhance user engagement, simplify issue resolution, and contribute to an overall positive customer experience.

The Webinar that might interest you: Are TuringBots Up for the AI Autonomous Testing Challenge? by Diego Lo Guidice, Forrester VP & Principal Analyst, and Ravi Sundaram, President, Qyrus Operations

AI in Fintech: Transforming Operations and Customer Experiences

The infusion of AI in Fintech goes beyond test automation; it extends to every facet of financial operations. From customer onboarding to fraud detection, AI algorithms are optimizing processes and mitigating risks. In customer onboarding, AI-powered systems streamline the verification process, reducing the time required to establish new accounts. This not only enhances user satisfaction but also contributes to operational efficiency.

Fraud detection, a critical concern in the financial industry, benefits immensely from AI’s predictive capabilities. Machine learning models analyze transaction patterns and identify anomalies indicative of fraudulent activities. The proactive nature of AI in fraud detection minimizes losses and fortifies the security infrastructure of Fintech platforms.

Moreover, AI-driven personalization is reshaping customer experiences in Fintech. By analyzing user behavior and preferences, AI algorithms tailor recommendations and services to individual needs. This level of customization not only improves customer satisfaction but also fosters loyalty in an increasingly competitive market.

The Role of AI and ML in Test Automation: Ensuring Robust Fintech Solutions

As Fintech companies integrate AI and ML into their operations, the need for robust testing becomes paramount. Here, the synergy between AI and ML in Test Automation, powered by TuringBots, plays a pivotal role. These intelligent bots meticulously test applications, identifying vulnerabilities and ensuring that security measures are foolproof.

The iterative nature of machine learning enables TuringBots to continuously evolve their testing methodologies. They learn from each testing cycle, adapting to new features and functionalities. This dynamic approach ensures that Fintech applications remain resilient in the face of evolving cyber threats and regulatory changes.

Check out how Shawbrook managed a 200% ROI within 12 months.

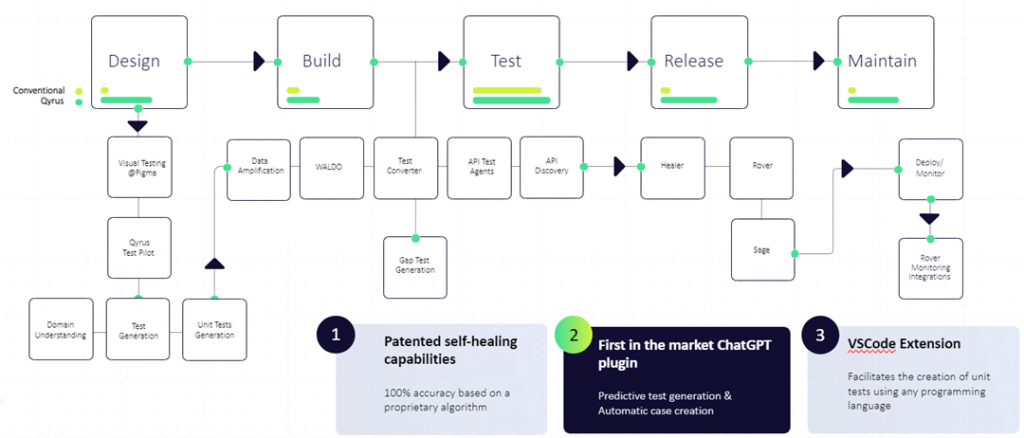

Qyrus TuringBots: Designed with Users in Mind, Enhanced with AI

Qyrus TuringBots or Single Use Agents (SUAs) serve distinct purposes such as generating scenarios or tests, data amplification, domain understanding, etc. By deploying an amalgamation of these SUAs, one can achieve ‘objecting-based testing’.

So, what all can a QyrusBot do?

Well, it can read Jira stories and tickets to create test automation scenarios, it can create realistic and diverse test data, analyze requirements and build APIs for testing, learn from past tests and suggest new test cases, and analyze logs and other data sources to identify potential risks, and the list goes on.

Qyrus enables AI algorithms across services to optimize the entire QA lifecycle.

Conclusion: Navigating the Future with AI/ML and TuringBots

In conclusion, the fusion of AI, ML, and TuringBots is reshaping the landscape of Fintech. The transformative power of these technologies is evident not only in test automation, but also in revolutionizing how financial services are delivered and experienced. Fintech trends underscore the industry’s trajectory towards a more secure, efficient, and customer-centric future.

As we move forward, Fintech companies that harness the potential of AI in their operations will stand at the forefront of innovation. The integration of TuringBots and AI/ML in Test Automation will be the cornerstone of this evolution, ensuring that Fintech solutions are not only cutting-edge but also resilient in the face of an ever-changing financial landscape. The future of Fintech is undeniably intertwined with the capabilities of AI, ML, and TuringBots, heralding a new era of possibilities and opportunities.